Don't fall for propaganda from the Federal Reserve about tapering quantitative easing, says ShadowStats editor John Williams in this interview with The Gold Report. His corrected economic indicators show the U.S. is nowhere near a recovery and the Fed will have to increase rather than decrease bond buying to prop up the banks and push off inevitable dollar debasement. That could be very bad for savers, but good for gold.

The Gold Report: On Wednesday, the Federal Reserve hinted that it might begin tapering quantitative easing by the end of the year based on signs of an improving economy. Gold immediately dropped from $1,347 an ounce ($1,347/oz) to $1,277/oz, a 7% decline and the lowest price in more than two years. The Dow Jones Industrial Average and NASDAQ were also off more than 2%. You called this "jawboning" and said that due to stresses in the banking system the Fed would be obliged to continue bond buying. Why would the central bank threaten to cut off the flow if it didn't plan to do it?

John Williams: All the hype over the Fed's so-called tapering is absolute nonsense. Fed chairman Ben Bernanke said the Fed's pulling back of quantitative easing was contingent on the economy recovering in line with the Fed's relatively rosy projections. He also indicated, however, that if the economy worsened, he would expand quantitative easing. When you consider that the official Fed projections are grossly optimistic, the conclusion is that we will have more, not less, bond buying from the government.

"The reality is that the economy is weak and it's going to get weaker."

The jawboning was a multifaceted attempt to placate the Fed's critics, while soothing the stock and bond market jitters at the same time. The comments, however, hammered equities and bonds, as well as gold. The negative impact on gold likely would have been viewed as a positive result by the Fed.

The banking system nearly collapsed in 2008. The federal government and Federal Reserve took extraordinary measures to keep the financial system from imploding. Those actions prevented an immediate systemic collapse, but they did very little to resolve the underlying problems. I contend that we're still in recession, with the economy deepening into a renewed downturn. At the same time, the banking system solvency problems continue. Little has changed in the last five years.

The purported nature of the quantitative easing is a fraud on the public. While Bernanke describes the extraordinary accommodation in terms of trying to stimulate the economy, lowering the unemployment rate and attaining sustainable economic growth in the context of mild inflation, those factors are secondary concerns for the Fed. The U.S. central bank's primary function always has been to assure banking system solvency and liquidity. All the easing efforts have been aimed at the banking system. The flood of liquidity spiked the monetary base, but it has not flowed through to the money supply and ordinary people.

Simply put, the Fed is propping up the banking system. Bernanke is using the cover of a weak economy to do that because the concept is not politically popular, but it's what the Fed has to do because the underlying system is just as broken today as it was in 2008.

TGR: Let's go back to your statement that the economy is doing worse rather than better. Didn't positive housing start statistics and consumer confidence numbers just come out? How do you know if the economy is getting better or worse?

JW: Housing starts are still down 60% from their peak. Based on the first two months of the second quarter, housing starts are on track for a quarter-to-quarter contraction, a rather substantial one. Industrial production also is on track for a quarterly contraction. These indicators easily could foreshadow a contraction in the current quarter's gross domestic product (GDP). The underlying economic issues remain, as in 2008, with structural constraints on consumer liquidity and banking system stability. With those ongoing, fundamental weaknesses, there has been no basis whatsoever for the purported economic activity since 2009, or for a recovery pending in the near term.

The consumer directly drives more than 70% of GDP activity. Indirectly, the consumer impacts the balance of the economy. To have sustainable growth in consumption, there needs to be sustainable growth in liquidity, reflected in income and, ideally, supported by credit. Instead, household income is shrinking and traditional consumer credit is heavily constrained.

"The underlying fundamentals remain extraordinarily strong for gold."

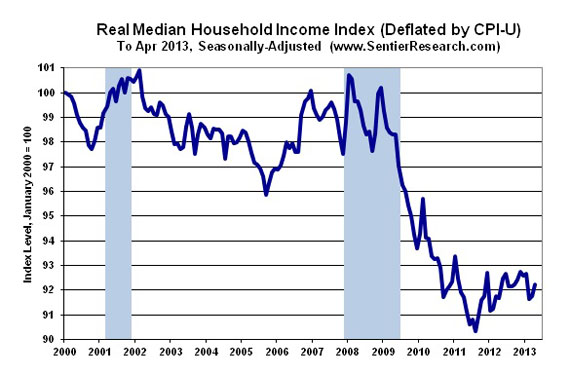

Headed by two former senior Census Bureau officials, SentierResearch.com publishes monthly estimates of median household income adjusted for the government's headline CPI inflation number. Those numbers show that household income plunged toward the end of the official economic downturn. Officially, the recession went from the end of 2007 to the middle of 2009, but the reality is that household income kept plunging after the middle of 2009. It hasn't recovered. Right now, it's flat and bottom-bouncing at the low level of activity for the cycle.

If you look at those numbers on an annual basis, again adjusted for headline CPI inflation, median household income in 2011 (latest available) is lower than it was in the late 1960s and early 1970s. The consumer here is in severe trouble. You can't have inflation-adjusted or real growth in consumption without real growth in income. Income drives consumption. That's basic.

You can buy a little extra consumption through debt expansion. The consumer in the precrisis era tended to maintain his or her standard of living by borrowing from the future. Recognizing a developing liquidity squeeze, then-Fed Chairman Alan Greenspan encouraged the consumer to take on as much debt as possible. In the decade prior to the 2008 panic, the bulk of economic growth was fueled by debt growth, not income growth. For the consumer, the credit crisis dried up everything except federally issued student loans, and those don't buy washing machines and houses.

If you don't have income growth or credit availability, that takes a toll on consumer confidence. Usually consumer sentiment follows the tone of the popular press on the economy, and monthly movement in the different consumer measures can be quite volatile. Despite the happy hype of recent headline monthly gains in consumer confidence, the news doesn't have much relevance to our being out of economic trouble. Consumer confidence plunged starting in 2006 and we've been bottom-bouncing ever since. Current levels are consistent with numbers seen during the depths of the worst recessions in the post-World War II era. We're still at recession levels in consumer confidence; those measures have not shown the full recovery that has been reported in the GDP.

Official GDP reporting shows that the economy turned down right after the end of 2007, plunged through 2008 into the middle of 2009, and then started turning higher and has continued higher ever since. If you believe the GDP numbers, the economy fully recovered as of the fourth quarter of 2011, regaining its prerecession highs, and has continued to expand ever since. No other economic series confirms that pattern.

The big issue in the reporting of the GDP is with the inflation-adjustment process. The government in the last several decades has changed its inflation estimation methodologies to lower the reported rate of inflation. In the case of the CPI adjustments, it's has been trying to cut budget deficits by using a lower inflation rate to calculate cost of living adjustments for Social Security. A number of the changes to CPI reporting also affected estimates of the GDP's implicit price deflator, the inflation measure used to remove the effects of inflation from the GDP calculations.

If you correct for the understatement of GDP inflation, the accompanying overstatement of economic growth reverses, showing that the GDP started to turn down in 2006, plunged into 2009 and has been bottom-bouncing along with other indicators, including housing starts, median household income and consumer confidence measures, and along with reporting of other series corrected for inflation overstatement, particularly industrial production and real retail sales. Other real world business indicators, including corporate sales of consumer products, are showing the same pattern of plunge and bottom-bouncing, as opposed to plunge and recovery. The reality is that the economy is weak and it's going to get weaker.

We haven't seen a recovery and that is why the Fed won't end quantitative easing. Any talk of tapering is pure propaganda to placate global markets on the U.S. dollar, trying to hit gold and maybe get a sense of how the markets would respond to an actual withdrawing of quantitative easing.

TGR: We saw the response loud and clear on Thursday.

JW: Yes, the stock market is like a drug addict and Bernanke's been the drug dealer, pushing direct liquidity injections.

TGR: The market came back a little bit on Friday. Do you think the plunge was just a temporary knee-jerk reaction and things will be back to their upward trajectory in no time?

JW: The stock market is irrational. It's heavily rigged with big players manipulating it, and with the President's Working Group on Financial Markets taking actions to prevent "disorderly" conditions in the equity market, as well as other markets. I would tend to avoid the stock market. Gold took a big hit, too, but the underlying fundamentals remain extraordinarily strong for gold. This is not a situation where everything's right again with the world and the Fed is going to pull back from debasing the dollar. If anything, the Fed is going to have to move further into dollar debasement. That is what Bernanke was saying. If the economy doesn't recover we've got to expand the easing. He is propping up the banking system under the cover of propping up the economy. Nothing that he is doing is helping the economy.

TGR: You called the dollar "a proximal hyperinflation trigger" and said that "gold is the primary and long-range hedge against the upcoming debasement of the dollar irrespective of any near-term price gyrations." Yet the dollar seems to be stronger than ever. What would trigger the dollar-selling panic that you have predicted by the end of the year?

JW: A visibly weaker economy could have a devastating impact on the dollar. It would force Bernanke to expand rather than contract quantitative easing. That would result in heavy selling pressure against the dollar and a spike gold prices.

"A visibly weaker economy could have a devastating impact on the dollar."

At present, there are four major factors out of whack between market perceptions and the fundamental, underlying reality. These misperceptions will tend to shift toward reality, and a confluence of these factors would be devastating to the U.S. currency.

At the top of the list, at the moment, is Fed policy, which we've been discussing. My contention is that the Fed is locked into quantitative easing. It can't escape it.

A close second are U.S. fiscal conditions and long-range sovereign insolvency risks. Fiscal issues should come to a head after Labor Day, when the government runs out of room with all its current bookkeeping finagling so as not to exceed the debt ceiling. Prospects for a meaningful resolution of the fiscal problems remain nil. In the summer of 2011, the market reaction to the government's fiscal inaction was clear: Heavy dollar selling and gold buying came out of that.

The third factor, again, is the economy being a great deal weaker than consensus expectations, based on the indicators I outlined. As weakening business conditions become more evident in the popular economic releases, that should be a large negative for the dollar. Aside from increasing speculation as to increased Fed easing, it also would have a negative impact on the federal budget forecasts going forward. Economic growth of 4% projected for 2014 is not going to happen. The deficit will explode, and, again, that is very bad for the dollar.

Finally, developing scandals in Washington have the potential to hit the dollar hard. The press has started raising questions about a number of cover-ups. I was involved in the currency markets during the Watergate era. I can tell you that on a day-to-day basis, as the scandal began to unfold, whenever the news was bad for President Nixon, the dollar took a hit. Anything that questions the stability of the government is a big negative for the dollar.

All of these factors work in conjunction with each other. That is why I am predicting a massive decline in the dollar at some point this year, which will spike inflation, certainly spike gold prices and will lead us into the very high inflation environment that will provide the basis for actual hyperinflation in 2014. It's not just current government actions. It's series of circumstances that have evolved over decades into a developing crescendo of dollar debasement or inflation.

TGR: You recently wrote that we're approaching the endgame based on volatility in equities, currencies and monetary precious metals of gold and silver. What will that endgame look like? And how will we know if we are in it?

JW: Primarily I would look at the U.S. dollar as an indicator, when very heavy, consistent, massive selling of the U.S. dollar and dollar-denominated assets begins. As the selling becomes heavier, pressure to remove the dollar from its current world currency reserve status should become unstoppable. I would take that as a sign that we are moving into the position that will set the stage for the hyperinflation.

TGR: Whatever happens in the economy, it sounds as if Bernanke's days will be numbered. What could that mean for economic policy and Federal Reserve actions? And what advice do you have for whoever takes his place?

JW: I wouldn't want to be the person who takes his place. Bernanke is a very smart and generally well-intentioned individual who's in a situation that was not of his creation, but one that he has been trying, with great difficulty, to extricate the Fed from. The Fed doesn't have any real options here. The best it can do is continue to buy time.

There's nothing the Fed can do that will stimulate economic activity, except possibly to raise interest rates. Low interest rates are actually negative for economic activity at this point. They constrain loan growth. With higher interest rates, banks have the ability to make more of a profit margin on their lending. The greater the profit margin, the greater the ability to lend to perhaps less qualified borrowers, to take a little more credit risk, but with that also comes loan growth. That helps fuel economic activity. It might even cause the money supply to pick up. The biggest constraint on bank lending, though, remains the still-troubled nature of the banking industry.

Separately, low interest rates devastate the finances of those trying to live on a fixed income. It used to be you could go invest your money in a CD and make a positive return, after inflation, and your money was safe, at least within the insured limits of the banking system. That's not the case anymore. Domestically, there is no safe investment where you can beat the rate of inflation. Government policies are driving savers into riskier investments, such as the highly unstable stock market.

TGR: So you think by default we will have a continuation of the current policies?

JW: Yes, effectively. The Federal Reserve board has run along with the program, moving in accord with the government to save the financial system. Back in 2008, it could have let the banking system fail. Understandably, though, the Fed and the federal government decided to save the system at all costs. That meant spending, creating, lending and guaranteeing whatever money was needed. Whatever had to be done they did. They prevented the system from collapsing, pushing the problems down the road. Now all those problems again are coming to a head. With many of the same risks in the system today, as in 2008, there is potential for another panic. The Fed has to keep easing here to maintain liquidity in the banking system. The U.S. central bank does not have a choice in the matter.

TGR: It sounds as if there isn't a lot that Bernanke's replacement could do. Would your only advice be don't hold a lot of press conferences?

JW: That would be a big plus. If there's bad news, basically the central banker has to lie. If he or she says, "The banks are going to collapse," or "The economy is going to hell," that will move the process along in a self-fulfilling negative cycle. Accordingly, central bankers often attempt to put false a positive spin on things. Having a Fed chairman hold press conferences is actually something relatively new. "Jawboning" was one tool Bernanke thought he could use to influence the economy and market behavior. That's deliberate policy, but it has problems, as we saw on Wednesday. The tradition for Fed chairmen has been to keep remarks to the minimum, whenever possible.

TGR: Sounds like some very good advice. Thank you for your time.

JW: Thank you.

www.centrifugalslurrypump.com is a leading company mainly devoting on offering the solutions of slurry pump application. We offered the professional slurry pump, gravel pump, vertical slurry pump and solutions and service all over the world!